25+ Heloc mortgage calculator

Apply for your home equity line of credit today. So for example if you were being offered a mortgage rate of 225 the lender might do a stress test to see if you could still afford payments at the.

Is The Total Interest Dollar Amount On A Home Mortgage Loan Fixed Or Can You Decrease It By Making Additional Principal Payments Quora

200000 Value of home x85 170000-120000 Mortgage balance 50000.

. Like a home equity loan a HELOC allows you to borrow from your homes equity. Calculate 1-Year 31 51 71 ARM Home Loan Payments Online for Free. 525 with autopay Customer experiences.

However youll borrow. The HELOC calculator is calculated based on your current HELOC balance interest rate interest-only period and the repayment period. If you would like the HELOC payment calculator to calculate the principal and interest payment that will begin once the draw period is over enter the number of years.

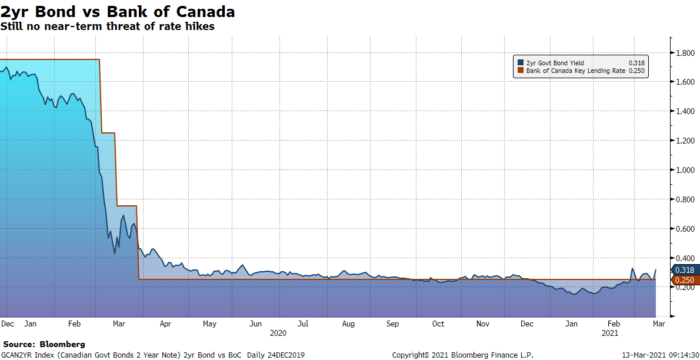

The maximum mortgage calculator will allow you to input your monthly obligations your monthly income to calculate the maximum monthly mortgage payment. The VA loan calculator provides 30-year fixed 15-year fixed and 5-year ARM loan programs. 2008 the Federal Reserve lowered the Federal Funds rate down to between 000 to 025.

Using a home equity loan can be a good choice if you can afford. The Feds decisions dont drive mortgage rates as directly as they do other products but players in the mortgage industry keep a close eye on the central bank which recently hiked its key rate. 85 of that is 170000.

On Wednesday September 07 2022 the current average 30-year fixed-mortgage rate is 602 increasing 8 basis points over the last week. The above calculator also has a second tab which shows the current interest rates on savings accounts. For example if your current balance is 100000 and your homes market value is 400000 you have 25 percent equity in the home.

For example a 30-year fixed mortgage will have a lower monthly payment than a 15-year fixed but will require you to pay more interest over the life of the loan. Like private student loan amounts private student loan repayment terms vary by lender. Mortgage refinance calculator.

The monthly payment reflects both the repayment for the cash out at closing and your monthly mortgage payment. CLTV is your overall mortgage loan debt expressed as a percentage of your homes fair market value. Take a sneak peek at the Ad-Free Design being enjoyed by hundreds of members for less than 25 a week.

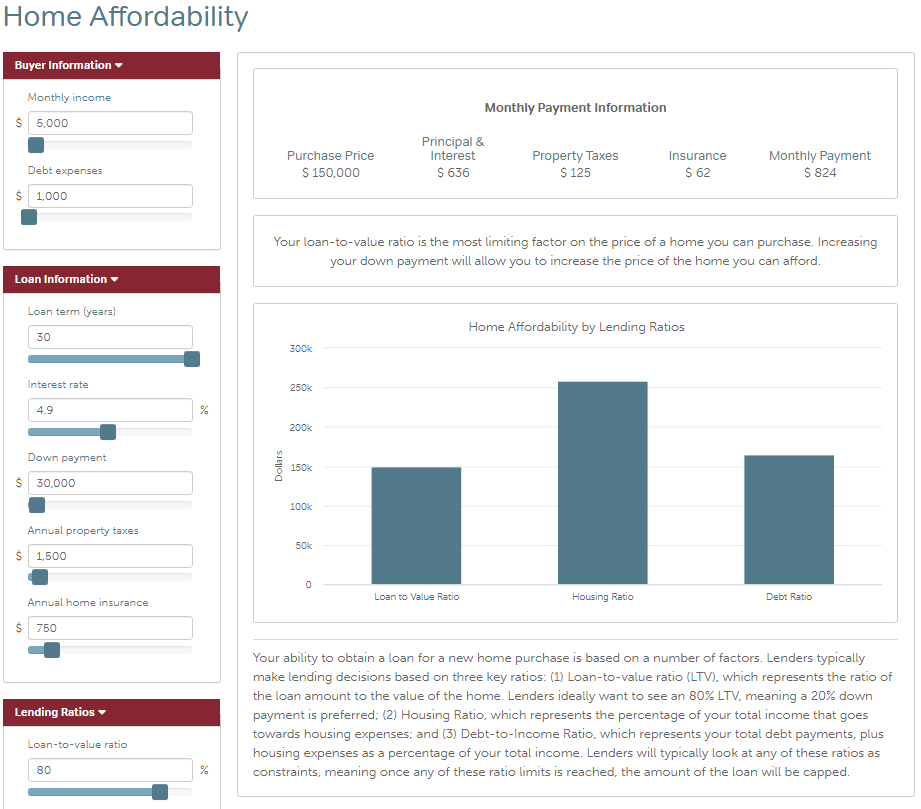

An income of 25 thousand dollars should leave you able to afford a house worth up to 80000. The calculator works immediately as you slide or input your gross monthly income monthly debts loan terms interest rate and down payment. See the Real Cost of Debt.

If your home is worth 100000 and you owe 40000 on your mortgage then your CLTV is 40. Mortgage Calculator excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments. PMI vs 2nd Mortgage.

Enter an amount between 0 and 25. Calculator HELOC Rates Mortgage Rates. The monthly interest rate is calculated via a formula but the rate can also be input manually if needed ie.

The loan program you choose can affect the interest rate and total monthly payment amount. A Smart Refinance loan is a no-closing-cost mortgage refinance option that lets you take advantage of lower rates get cash out at closing and change your loan term to 5 10 15 or 20 years. In addition to the standard mortgage calculator this page lets you access more than 100 other financial.

Of course mortgage regulations changes from province to province so its crucial that the mortgage calculator you use is specific to where you live. When rates are rising people tend to choose to get a second mortgage HELOC or home equity loan instead of. Used as part of a down.

When you get a HELOC through Prosper your mortgage and HELOC combined can be worth as much as 90 of your homes fair market value. Total Of Payments. Mortgages originated before 2018 will remain grandfathered into the older limit mortgage refinancing of homes which had the old limit will also retain the old limit on the new refi loan.

Annual interest rate for this mortgage. This further shows how expensive debt is because most forms of consumer debt charge a far higher rate of interest than banks pay savers AND savers get taxed on interest income they earn at their ordinary tax rates. Then adjusts for the next 25 years.

Home Mortgage Calcs HELOC Payment Calculator. Rates remained pinned to the floor until they were gradually lifted from December 2015 until present day. The mortgage interest deductibility limit was also lowered from the interest on 1 million in debt to the interest on 750000 in debt.

However student loans that are under an alternative payment plan offer terms from 10 to 25 years. Appraised property value. 71 ARM - Your APR is set for seven years then.

Todays national mortgage rate trends. HELOC Calculator HELOC. Replacing a prior HELOC with a better rate or other advantageous change of terms.

Set up and maintain automatic monthly payments from your Bank of America checking or savings account and receive a 025 interest rate discount does. The most common type of open mortgage is the Home Equity Line of Credit HELOC. Mortgage home equity etc.

To use our mortgage calculator slide the adjusters to fit your financial situation. Property Value. If you still owe 120000 on your mortgage youll subtract that leaving you with the maximum home equity line of credit you could receive as 50000.

Enter an amount between 0 and 25. For example say your homes appraised value is 200000. HELOC Payment Calculator excel to calculate the monthly payments for your HELOC loan.

Start interest rates at. To estimate the cost of breaking your mortgage our mortgage penalty calculator is a useful tool. Download a free ARM calculator for Excel that estimates the monthly payments and amortization schedule for an adjustable rate mortgageThis spreadsheet is one of the only ARM calculators that allows you to also include additional payments.

That number could rise up to over a hundred thousand with an extended loan term. Auto Loan Payoff Calculator. Our mortgage qualifying calculator will give you a precise.

Get an estimated monthly payment and rate for a home equity line of credit with our HELOC calculator. Auto Loan Payoff Calculator. Scroll down the page for more detailed guidance on using this mortgage calculator and frequently asked.

A mortgage calculator gives you valuable insight into what your regular payments and amortization sschedule will be in different scenarios eg different mortgage amounts different rates etc.

Mortgage Payoff Tracker Great Way To Keep Yourself Organized And See Your Progress On Your Mortgage Paym Mortgage Payoff Debt Payoff Printables Mortgage Debt

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Fixed Mortgage Rates Highest Since August Ratespy Com

Fixed Mortgage Rates Highest Since August Ratespy Com

Why Would Anyone Buy A 5 Unit Rental Property Having To Pay 25 Down When They Can Just Buy A 4 Unit And Pay 5 Down Quora

Heloc Mortgage Accelerator Spreadsheet Pay Off Mortgage Early Mortgage Loan Calculator Mortgage Loans

The Loan Vs The Line Of Credit Home Equity Loans Home Equity Loan Home Equity Home Improvement Loans

25 Spreadsheet Templates To Manage Your Daily Finances Supermoney

Home Equity Calculator For Excel Home Equity Loan Calculator Home Equity Loan Home Equity

Residential Refinance Originations Increase Q4 Of 2016 Think Realty A Real Estate Of Mind

In Times Of Uncertainty Take Stock Of Your Cash For Financial Samurai

Residential Refinance Originations Increase Q4 Of 2016 Think Realty A Real Estate Of Mind

Increasing Passive Income Through Leverage And Arbitrage

Fixed Mortgage Rates Highest Since August Ratespy Com

/GettyImages-183784889-5a6b3eddfa6bcc0037f464b0.jpg)

Refinancing Risk Definition

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Mortgage Amortization Calculator Home Equity Loan

News Resources At Members First Credit Union Members First Credit Union